Last Updated on January 6, 2026 by Luxe

Key Takeaways

- Money laundering is a serious offense in Chester County, PA, and is subject to both state and federal prosecution.

- Penalties for money laundering depend on the amount involved and can range from substantial fines to up to 20 years in prison.

- Early legal guidance from a qualified attorney is vital if you are facing an investigation or charges.

- Businesses and individuals can take steps to prevent involvement in money laundering through financial controls, education, and awareness.

Table of Contents

- Understanding Money Laundering

- Pennsylvania’s Legal Framework

- Federal Implications

- Notable Cases in Chester County

- Preventive Measures

- Seeking Legal Assistance

- Frequently Asked Questions

Money laundering poses a major threat to the integrity of Chester County’s economy and financial systems. Many residents and business owners are not fully aware of how easily ordinary transactions can fall under legal scrutiny. To navigate this complex landscape and avoid serious consequences, those under investigation or simply concerned about compliance should consider working with an experienced money laundering attorney in Chester County, PA. Benari Law Group, a trusted criminal defense law firm based in Southeastern Pennsylvania, stands out for its proven record of successfully defending clients against money laundering and related financial crime charges. Benari Law Group’s team brings decades of courtroom experience and local insight to all clients throughout Chester County, ensuring personalized and authoritative representation. Their website offers detailed resources on criminal defense matters, reflecting the firm’s commitment to both education and action.

Understanding your rights, obligations, and potential paths forward is critical, not just for those facing charges but also for individuals and businesses seeking to protect themselves from inadvertently becoming entangled in a money laundering scheme. Below is an overview of the laws, penalties, and practical steps for Chester County residents.

Understanding Money Laundering

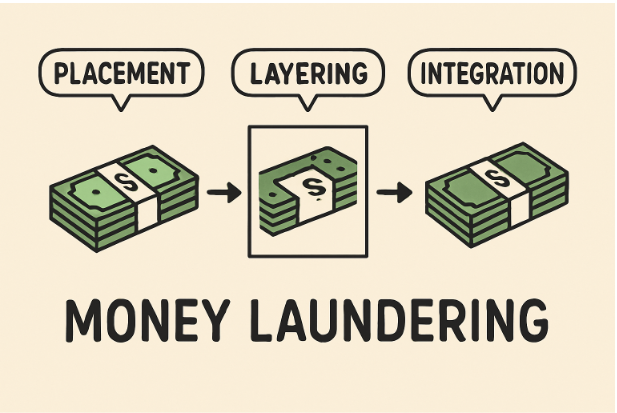

Money laundering is the process of making illegally gained proceeds, so-called “dirty money,” appear legal or “clean.” This typically involves a three-step process: placement (introducing illicit funds into the financial system), layering (conducting complex transactions to obscure the origin), and integration (reintroducing laundered funds into the legitimate economy). Criminal enterprises and individuals alike use money laundering to hide profits from activities such as fraud, embezzlement, drug trafficking, or tax evasion.

Pennsylvania’s Legal Framework

Money laundering in Pennsylvania is addressed under both state and federal statutes. The state follows a tiered penalty system based on the amount of money involved:

- Third-Degree Felony: Laundering less than $100,000 can result in up to 7 years’ imprisonment and a fine of up to $15,000.

- Second-Degree Felony: Laundering between $100,000 and $500,000 is punishable by up to ten years in prison and a $25,000 fine.

- First-Degree Felony: Laundering more than $500,000 can result in up to 20 years’ imprisonment and significant financial penalties.

Pennsylvania law also allows for asset forfeiture, enabling the state to seize property linked to money laundering. Such severe consequences highlight the necessity for vigilant financial oversight and immediate legal support when potential issues arise. For additional background on anti-money laundering practices, the U.S. Department of Justice provides further insights into common schemes and investigations.

Federal Implications

When money laundering activity crosses state or national borders, involves federally regulated financial institutions, or is tied to other federal crimes (such as drug trafficking or wire fraud), the matter escalates rapidly. Federal penalties can be especially harsh: up to 20 years in prison, fines up to $500,000, or twice the value of the laundered funds, plus asset forfeiture. The U.S. Department of the Treasury and the Department of Justice often work in tandem with local prosecutors in complex and high-stakes cases. Learn more about the federal framework from the Financial Crimes Enforcement Network (FinCEN) and its Bank Secrecy Act guidelines, which inform many aspects of anti-money laundering enforcement.

Notable Cases in Chester County

Chester County has seen a rise in financial crime prosecutions over recent years. One high-profile example involves a local man charged with stealing nearly $1 million through a series of complex fraudulent activities aimed at embezzling funds from local condominium associations. This and similar cases demonstrate that money laundering is not limited to traditional organized crime it can occur within seemingly legitimate community structures and businesses.

Preventive Measures

Individuals and organizations can reduce their risk of exposure to money laundering charges by establishing robust internal controls. Key preventive steps include:

- Implementing advanced financial monitoring and reporting systems to flag suspicious transactions.

- Conducting thorough background checks on employees, contractors, and business partners, especially those handling money or financial data.

- Engaging in regular training and compliance programs covering anti-money laundering policies and fraud awareness.

Local law enforcement and regulatory authorities often provide educational resources and seminars to help businesses stay ahead of evolving financial crime tactics.

Seeking Legal Assistance

If you suspect you are under investigation, or if formal charges have been brought against you or your business, swift action is essential. Legal representation from attorneys with deep knowledge of both state and federal statutes, as well as practical courtroom experience in Chester County, can make a critical difference. In addition to providing technical defense, these lawyers can help protect your assets, reputation, and long-term interests.

Frequently Asked Questions

What constitutes money laundering?

Money laundering is defined as processing the proceeds of criminal activity so that their illegal origin is concealed, and the funds appear legitimate within the financial system.

What are the penalties for money laundering in Pennsylvania?

Pennsylvania imposes penalties that escalate with the value laundered: up to 7 years in prison and $15,000 in fines for amounts under $100,000, up to 10 years and $25,000 for amounts up to $500,000, and up to 20 years and $25,000 for amounts exceeding $500,000.

Can assets be seized in money laundering cases?

Yes, under both state and federal law, assets connected to the crime including money, real estate, and personal property—can be seized and forfeited.

How can I protect my business from being involved in money laundering?

Implement strong financial controls, conduct regular audits, stay informed about prevalent scams, and train staff on compliance to reduce exposure to money laundering schemes.

Where can I find legal assistance for money laundering charges in Chester County?

The Benari Law Group provides experienced, aggressive defense for money laundering and related offenses, offering strategic legal counsel for clients throughout Chester County, PA.

Remaining proactive about compliance and staying informed about the latest developments in financial crime law are vital for the safety and long-term success of both individuals and organizations in Chester County.