Contents

Key Takeaways

- Asset allocation is the foundation of a balanced investment strategy that tailors risk and reward to your financial goals.

- Diversification and regular rebalancing are essential for long-term portfolio health.

- Understanding your risk tolerance and investment timeline guides your core asset mix.

- Controlling costs ensures you keep more of your investment returns.

Table of Contents

- Understanding Asset Allocation

- Key Components of a Diversified Portfolio

- Steps to Build Your Core Asset Mix

- Sample Asset Allocation Models

- Importance of Diversification

- Regular Rebalancing

- Controlling Costs

- Final Thoughts

Understanding Asset Allocation

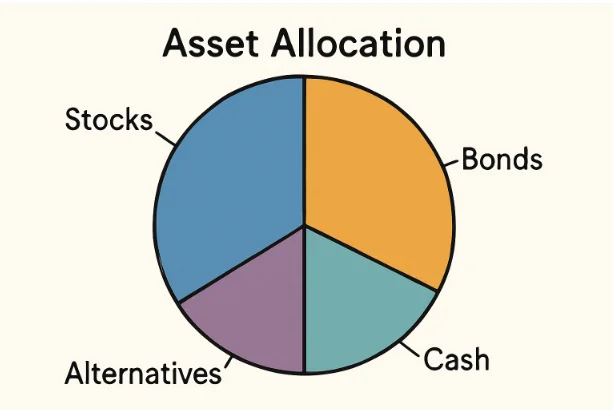

Asset allocation refers to your strategy for dividing investments among different asset classes, typically stocks, bonds, cash, and, sometimes, alternative assets. This essential process gives your portfolio a foundation that balances risk with potential reward, and is widely accepted as one of the most important decisions you’ll make as an investor. The mix you choose will shape your portfolio’s long-term performance and resilience in changing markets. For many investors, understanding the importance of building a portfolio with the right allocation is a critical step toward achieving lasting financial success.

Asset allocation is not just about picking investments. It’s about structuring your portfolio so it can weather good times and bad, aiming to fulfill your specific objectives, whether saving for retirement, a home, education, or wealth preservation. Knowing how to construct your core mix allows you to control your exposure to riskier or more stable assets.

Every investor’s optimal allocation is different, based on factors such as financial goals, risk tolerance, and investment time frame. These variables determine whether you need growth, income, or capital preservation, and in what proportion. By matching your asset mix to your needs, you can navigate market ups and downs with greater confidence.

A thoughtful, well-defined asset allocation can also help reduce emotional investment decisions during market volatility, keeping you focused on long-term results rather than short-term noise.

Key Components of a Diversified Portfolio

- Equities (Stocks): These are the growth engine of a portfolio. Stocks offer the most potential for high returns, although they often come with greater volatility and risk.

- Fixed Income (Bonds): Bonds contribute stability and income. They tend to move differently from stocks, often rising in value when stocks are falling, making them invaluable for risk management.

- Cash and Cash Equivalents: These provide liquidity and safety. While they generally offer lower returns, their predictability and access in emergencies are crucial.

- Alternative Investments: Real estate, commodities, and hedge funds fall into this category. They often have low correlation to traditional assets, providing further diversification and potential inflation protection.

The right blend of these components depends heavily on your investment profile. Regularly reviewing your holdings helps ensure you remain aligned with your intended risk and return targets

Steps to Build Your Core Asset Mix

- Assess Your Financial Goals: Define your primary reasons for investing, such as retirement, children’s education, or a major purchase.

- Evaluate Your Risk Tolerance: Assess your emotional and financial ability to handle losses. Risk tolerance naturally varies from person to person and even changes throughout different life stages.

- Determine Your Time Horizon: The period until you need your investments is vital. A longer horizon allows for more risk, whereas a shorter one calls for greater caution.

- Select Appropriate Asset Classes: Allocate your portfolio’s assets according to your goals and risk profile. Younger investors might lean toward higher equity allocations, while those near retirement may favor bonds and cash.

- Implement and Monitor: After choosing your investments, consistently monitor and adjust your portfolio, ideally at least once a year or after major life changes.

Sample Asset Allocation Models

Portfolios can be structured in various ways depending on risk tolerance and investment objectives:

- Conservative Portfolio: Typically composed of 30% equities, 50% bonds, 10% cash, and 10% alternative investments. This mix prioritizes capital preservation and tries to minimize volatility.

- Moderate Portfolio: A middle-of-the-road approach, commonly split among 50% equities, 30% bonds, 10% cash, and 10% alternatives.

- Aggressive Portfolio: Geared toward higher growth, this model often includes 70% equities, 20% bonds, 5% cash, and 5% alternatives. It is suited to investors who can handle more risk and market swings.

Importance of Diversification

Diversification means investing across different asset types and sectors so that declines in one area do not overly harm your entire portfolio. This principle is central to modern portfolio theory and has been shown to reduce risk without necessarily sacrificing long-term returns. Instead of relying solely on one asset class or market, spreading investments helps smooth out returns while lowering the likelihood of major losses.

Regular Rebalancing

Over time, certain assets may outperform others, causing your portfolio to drift from your initial allocation. Regular rebalancing involves selling some assets and buying others to restore your intended mix. This simple practice ensures your portfolio continues to reflect your risk level and goals, especially during periods of market volatility or after reaching personal milestones.

Controlling Costs

Investment costs, including management fees, trading commissions, and expense ratios, can significantly erode your returns. Opt for low-cost index funds and exchange-traded funds (ETFs) whenever possible, as these often offer broad diversification at a fraction of the cost of actively managed funds.

Final Thoughts

Successful investing does not require predicting the future, but it does involve a disciplined approach to building and maintaining your asset allocation. By understanding the fundamentals of asset classes, setting clear goals, and monitoring your progress, you can build a resilient portfolio that withstands market volatility and helps you reach your long-term objectives.