The global payments landscape continues to evolve at a breathtaking pace, with businesses across industries seeking efficient, scalable, and customizable payment solutions to meet the demands of their customers. As we move through 2025, white label fintech solutions have emerged as the preferred choice for companies looking to launch or expand their payment services without the time, cost, and complexity of building infrastructure from scratch. These platforms enable businesses to offer comprehensive payment processing capabilities under their own brand while leveraging proven technology, extensive integrations, and regulatory compliance built by specialized providers.

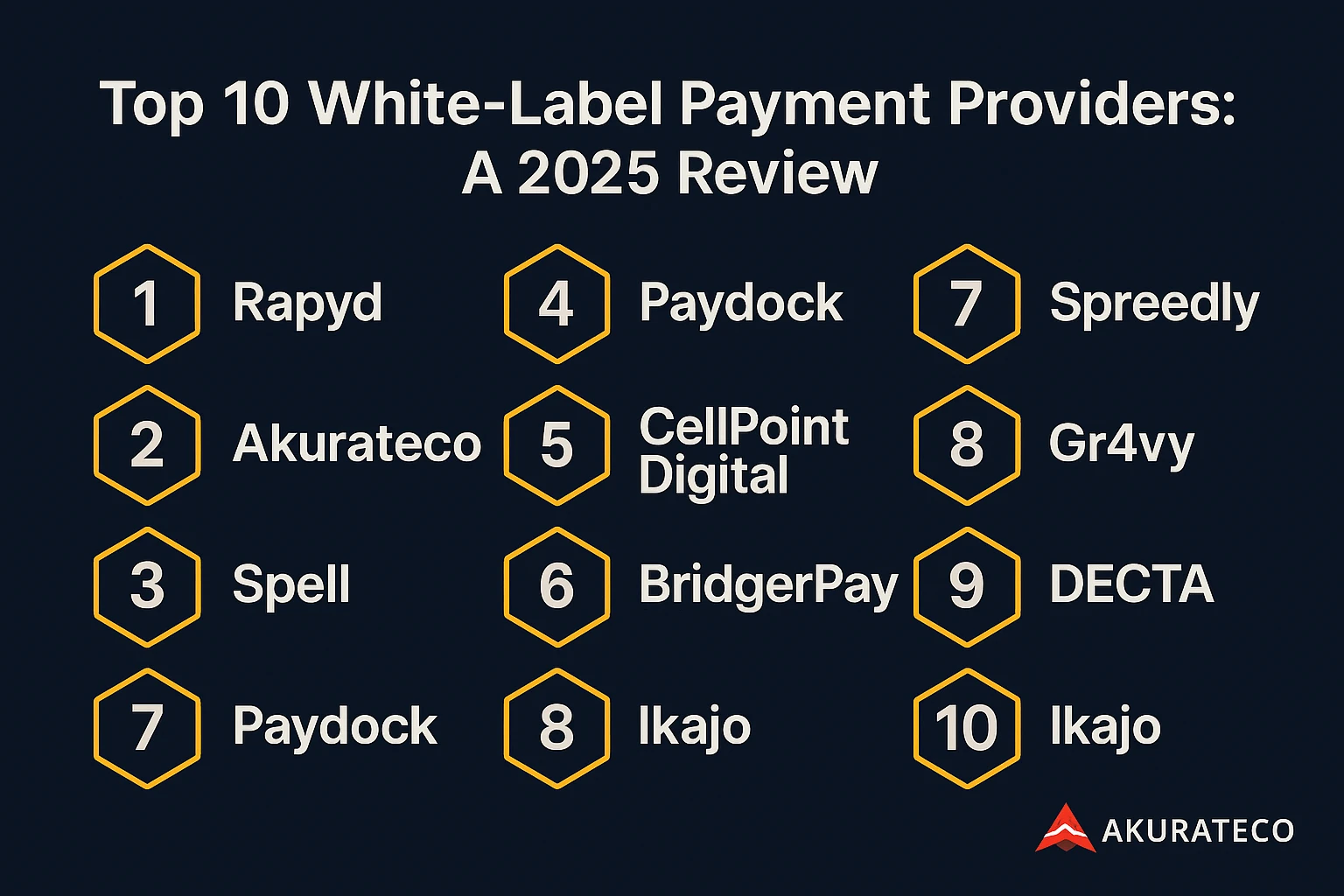

In this comprehensive review, we examine the top 10 white-label payment providers that are shaping the industry in 2025. Each platform brings unique strengths to the table, whether it’s geographic coverage, specific feature sets, integration capabilities, or deployment flexibility. Whether you’re a startup looking to enter the payments space, an established business seeking to reduce processing costs, or a financial institution aiming to enhance merchant services, this guide will help you navigate the competitive landscape and identify the solution that best aligns with your strategic objectives.

Contents

1. Rapyd

Rapyd has established itself as a global fintech-as-a-service platform with an impressive reach spanning over 100 countries. The company’s strength lies in its comprehensive approach to payment orchestration, combining payment processing, local payment methods, and embedded financial services into a unified platform.

What sets Rapyd apart is its extensive coverage of local payment methods across different regions. The platform supports over 900 payment methods, including mobile wallets, bank transfers, and cash-based solutions that are critical for markets with lower banking penetration. This makes Rapyd particularly attractive for businesses looking to expand internationally and accept payments in the way local customers prefer.

The platform’s API-first architecture enables rapid integration and deployment, with well-documented endpoints that developers appreciate. Rapyd also offers collect, disburse, and wallet services, creating a full-stack solution for businesses that need to both accept and send payments globally. Their compliance infrastructure is robust, with licenses and partnerships that enable operations across multiple regulatory jurisdictions.

However, businesses should be aware that Rapyd’s pricing structure can be complex, with fees varying significantly based on payment methods, geography, and transaction volumes. The platform is generally best suited for mid-to-large enterprises with significant international transaction volumes rather than small startups.

2. Akurateco

For businesses seeking a truly comprehensive white-label solution with deep payment expertise, Akurateco represents an exceptional choice. Founded by payment industry veterans with over 50 years of combined experience, the platform was built from the ground up to address real-world challenges faced by payment service providers, merchants, and financial institutions.

Akurateco’s white-label fintech platform distinguishes itself through its remarkable flexibility in deployment options. Businesses can choose between SaaS, on-premises, or cloud-agnostic implementations, ensuring compliance with local data residency requirements while maintaining full control over their payment infrastructure. This flexibility is particularly valuable for regulated markets where data sovereignty is a critical concern.

The platform’s feature set is extensive and thoughtfully designed. With over 600 global and local payment integrations ready to deploy, businesses can quickly expand their acceptance capabilities across multiple regions and payment methods. The intelligent payment routing and retry logic help maximize approval rates, while robust fraud prevention and chargeback management tools protect revenue. For businesses focused on recurring revenue models, Akurateco’s smart billing and subscription management features streamline operations and reduce churn.

What truly differentiates Akurateco is the “Payment Team as a Service” approach. Beyond standard technical support, clients gain access to dedicated payment experts who help optimize payment strategies, navigate complex compliance requirements, and solve sophisticated technical challenges. This level of partnership is invaluable for businesses looking to understand how to create a payment gateway that not only meets today’s needs but scales effectively for future growth.

Akurateco maintains PCI DSS Level 1 certification and full GDPR compliance, ensuring that security and regulatory requirements are met at every level. The platform has successfully empowered diverse clients, from regional PSPs like TESS Payments in Qatar and Dinero Pay in Saudi Arabia to processing centers like AzeriCard, demonstrating its versatility across different business models and geographic markets.

For businesses that value not just technology but true partnership and payment expertise, Akurateco offers a compelling proposition that balances comprehensive functionality with practical, real-world support.

3. Spell

Spell positions itself as a payment orchestration platform designed specifically for businesses that process payments across multiple channels and geographies. The platform’s core strength lies in its ability to connect to numerous payment service providers through a single integration, simplifying the technical complexity of managing multiple payment relationships.

The Spell platform offers intelligent routing capabilities that automatically direct transactions to the optimal payment provider based on various factors including cost, conversion rates, and reliability. This optimization can significantly impact bottom-line performance for businesses with substantial payment volumes.

One of Spell’s notable features is its unified reporting dashboard, which consolidates transaction data from all connected payment providers into a single view. This eliminates the need to log into multiple systems and reconcile data manually, saving operational time and reducing errors.

However, Spell is primarily focused on orchestration rather than providing direct payment processing, which means businesses still need to establish relationships with underlying payment service providers. The platform works best for companies that already have or are willing to manage multiple PSP partnerships.

4. Paydock

Paydock has carved out a strong position in the Asia-Pacific market, though its reach has expanded globally in recent years. The Australian-based company offers a payment orchestration platform with a particular focus on reducing payment complexity for merchants and enabling seamless omnichannel experiences.

The platform’s unified API connects to multiple payment gateways, alternative payment methods, and fraud prevention tools, allowing businesses to manage their entire payment stack from one place. Paydock’s approach emphasizes simplicity and speed of integration, with pre-built connectors that can be deployed rapidly.

The company’s focus on customer experience extends to its approach to implementation and support, with a reputation for responsive service and practical guidance. While Paydock may not have the same scale of integrations as some larger competitors, its focused approach and regional expertise make it a solid choice for businesses with strong APAC presence.

5. CellPoint Digital

CellPoint Digital brings a unique perspective to the payment orchestration space, having originated in the travel and aviation industry before expanding to serve broader e-commerce markets. This heritage has shaped the platform’s capabilities, particularly around complex payment scenarios involving multiple parties, currencies, and regulatory frameworks.

The platform’s payment orchestration engine is sophisticated, offering advanced routing logic that can consider factors beyond simple optimization metrics. Businesses can configure routing rules based on customer segments, risk profiles, payment amounts, and other business-specific criteria, enabling highly customized payment strategies.

While the platform’s complexity is an asset for large enterprises with sophisticated requirements, smaller businesses may find it more than they need. CellPoint Digital is best suited for companies with complex payment needs and the technical resources to fully leverage the platform’s advanced capabilities.

6. BridgerPay

BridgerPay has emerged as a comprehensive payment orchestration platform with a strong focus on maximizing conversion rates and providing businesses with complete payment flexibility. The Israeli-based company has built a platform that emphasizes both breadth of payment options and depth of optimization capabilities.

One of BridgerPay’s key differentiators is its extensive network of payment service providers and alternative payment methods. The platform connects to over 400 PSPs and local payment methods, giving businesses exceptional flexibility in how they accept payments across different markets. This extensive connectivity is particularly valuable for businesses expanding into new geographic regions where local payment preferences vary significantly.

The platform’s cascading feature is sophisticated, automatically routing failed transactions through multiple payment providers in real-time until a successful authorization is achieved. This approach can significantly reduce decline rates and recover revenue that would otherwise be lost. BridgerPay also offers A/B testing capabilities, allowing businesses to experiment with different payment flows and identify the configuration that delivers the highest conversion rates.

BridgerPay’s client base spans diverse industries including e-commerce, iGaming, forex, and travel, demonstrating the platform’s versatility. The company’s focus on customer success, with dedicated account management and optimization consulting, adds value beyond the technology itself.

7. Spreedly

Spreedly is a veteran in the payment orchestration space, having pioneered the concept of payments-as-a-service before the term became widely adopted. The company’s open payments platform enables businesses to connect to multiple payment services through a single integration, providing flexibility and reducing vendor lock-in.

What distinguishes Spreedly is its platform-agnostic approach and commitment to neutrality. Unlike some competitors that may have preferred partnerships with certain payment providers, Spreedly maintains an independent stance that allows businesses to work with any payment service they choose. This neutrality is valuable for enterprises that want to maintain control over their payment strategy without being influenced by platform biases.

Spreedly’s API-first design and extensive documentation make it popular with development teams. The platform is particularly well-suited for enterprises with technical resources who want maximum flexibility and control over their payment infrastructure.

The company has built a strong reputation for reliability and uptime, which is critical for payment infrastructure. Spreedly’s client base includes major enterprises across various industries, reflecting the platform’s ability to handle high transaction volumes and complex requirements.

8. Gr4vy

Gr4vy represents a newer generation of payment orchestration platforms, built with a cloud-native architecture that emphasizes scalability, security, and deployment flexibility. The company’s approach addresses several pain points that have emerged as the payment orchestration space has matured.

One of Gr4vy’s defining characteristics is its cloud-agnostic infrastructure. Unlike platforms tied to specific cloud providers, Gr4vy can be deployed on AWS, Google Cloud, Azure, or other infrastructure, giving businesses complete control over where their payment data resides. This is increasingly important as data residency regulations become more stringent across different jurisdictions.

The platform operates on an SaaS model but can be deployed in the customer’s own cloud environment, combining the benefits of managed software with the security and compliance advantages of controlled infrastructure. This deployment model, sometimes called “SaaS-on-prem,” appeals to enterprises with strict data governance requirements or those operating in heavily regulated industries.

Gr4vy’s modern technology stack and developer-friendly approach have made it popular with technology-forward companies and digital-native businesses. While the company is younger than some competitors, its innovative approach to solving payment infrastructure challenges has earned it a strong position in the market.

9. DECTA

DECTA offers a distinctive proposition in the white-label payment space, combining payment processing capabilities with issuing and acquiring services under one roof. The company’s integrated approach enables businesses to manage multiple aspects of the payment value chain through a single provider.

Based in Europe with a strong presence in the CIS region, DECTA brings particular strength in serving businesses operating in or expanding into Eastern European and Central Asian markets. The company’s deep understanding of regional payment preferences, regulatory requirements, and banking relationships provides valuable advantages for businesses targeting these geographies.

DECTA’s white-label platform encompasses payment gateway functionality, card acquiring, alternative payment methods, and merchant services. This comprehensive suite allows businesses to launch payment services quickly without needing to assemble capabilities from multiple providers. For companies looking to become payment service providers themselves, DECTA offers the infrastructure and support needed to get to market efficiently.

DECTA’s client portfolio includes banks, PSPs, and online businesses across diverse industries. The company’s experience working with financial institutions gives it particular expertise in navigating complex regulatory and compliance requirements that traditional banks face when offering payment services.

10. Ikajo

Rounding out our list is Ikajo, a payment service provider that offers white-label solutions with a particular focus on high-risk and challenging industries. While many payment providers shy away from complex or higher-risk business models, Ikajo has built expertise in serving merchants that may struggle to find payment solutions through traditional channels.

Ikajo’s platform provides comprehensive payment processing capabilities, including support for multiple currencies, payment methods, and geographic markets. The company has built relationships with acquiring banks and payment partners willing to work with industries that face higher chargeback risks or regulatory scrutiny, such as nutraceuticals, CBD products, subscription services, and forex trading.

The platform includes essential features for managing payment operations, including real-time reporting, fraud screening, chargeback management, and reconciliation tools. Ikajo’s approach emphasizes practical functionality that addresses the day-to-day needs of payment operations teams rather than overwhelming clients with excessive complexity.

For businesses operating in industries that traditional payment providers consider challenging, Ikajo offers a viable path to accepting online payments with proper support and risk management. The company’s willingness to work with complex business models, combined with its focus on building long-term partnerships, makes it a valuable option for merchants who need more than just technology.

Conclusion

The white-label payment provider landscape in 2025 is characterized by diversity, with platforms optimizing for different business models, geographic markets, and strategic priorities. From comprehensive platforms like Rapyd and Akurateco that serve as full-stack solutions, to specialized orchestration layers like Spreedly and Gr4vy that emphasize flexibility and choice, businesses have numerous excellent options to consider.

When evaluating white-label payment providers, businesses should consider several key factors beyond just features and pricing. Geographic coverage and support for local payment methods matter significantly for international operations. Deployment flexibility and data residency options are increasingly important as regulations evolve. The quality of documentation, developer experience, and technical support can dramatically impact implementation timelines and ongoing operational efficiency.

As the payments industry continues its rapid evolution, with new payment methods emerging, regulations changing, and customer expectations rising, choosing the right white-label payment provider is a decision that will shape a business’s competitive position for years to come. The providers featured in this review represent the leading options available in 2025, each bringing unique strengths that serve different business needs and strategic objectives.